From the Lifesprk long-term care insurance blog series

To understand what long-term care insurance can mean to you, it can be useful to think of it as a long-term care “bank account.” But instead of the money sitting in a bank, it’s being held by an insurance company, ready for you to use when you have a qualifying long-term care event.

Just like having your savings guaranteed by the FDIC [Federal Depository Insurance Corporation], you have a legal contract with an insurer to fulfill the terms of your policy. That’s one of the reasons you should work with an agent you trust to recommend an insurer who has the financial substance to fulfill their obligations to their policyholders.

Three steps go into calculating your immediate and future long-term care insurance “bank account.”

Step 1: Select Your Monthly Benefit: From $1500 to $9,000 and anywhere in between, usually in $250 or $500 increments. This establishes the maximum amount that you can receive from the insurer in any month, based on having qualified expenses.

Step 2: Select Your Total Benefit: In most policies this is expressed as a total dollar amount, like $50,000 to $1,000,000. To determine the minimum time the benefit would last, divide the maximum Monthly Benefit into the Total Benefit. For example, divide $250,000 by $5,000/month which = 50 months, divided by 12 months = 4.1 years. If you only used the benefit at the rate of $2,500/month, it would last 8.2 years.

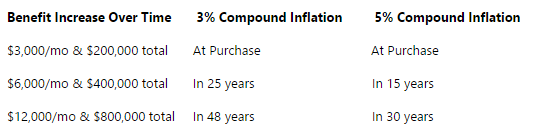

Step 3: Select Your Inflation Protection Option or Benefit Increase Option. This feature works similar to traditional savings accounts or CDs where the bank pays you interest on your account(s). The one big difference with long-term care insurance policies and traditional bank accounts is that you don’t have to wait for meaningful growth with a long-term care policy. As inflation grows so does your long-term care policy.

Impact of 3% and 5% Inflation Protection on Long-Term Care Insurance Benefits:

Buying a long-term care insurance policy means you’re going to build an affordable Long-Term Care “Bank Account” to protect you from a future long-term care event. It’s a lot better than a just a bank account because you can choose to get meaningful interest rate growth now, which you can’t get from a bank today. If you choose to buy without inflation protection, which is less expensive, there is usually a guaranteed right, irrespective of your health, to buy inflation protection in the future, based on your attained age.

Be sure to subscribe to our Seek On blog to receive every post in this series straight to your inbox!