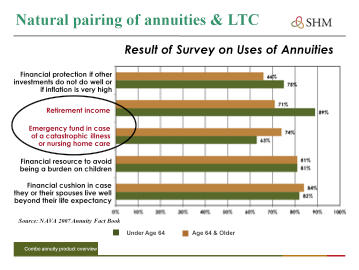

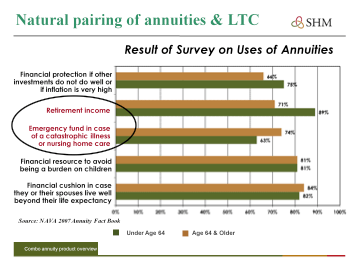

Surveys regularly show that when people describe what they have saved, over a lifetime, above what they need to live on, they often use words like a “nest egg,” “something to fall back on,” or a “rainy day fund.” When asked to explain for what they would use these funds, among the highest ranking answers is “emergency fund in case of a catastrophic illness or nursing home care”.

Here’s an example of how someone could fund a future long-term care event. Let’s say that you are 55 years old and wanted to begin protecting yourself now for a $100,000 long-term care event in 20 years when you’re 75. There are 3 simple ways to accomplish this:

- Invest a lump sum of $53,000 or

- Invest $3,500 annually for 20 years. With a 3% growth over 20 years this would grow to $100,000

- Buy a $100,000 long-term care insurance policy for $1200 per year per couple [assumes they are in in average health for 55 year olds]. Over 20 years, the premium cost will be $24,000.

As the chart shows below, not only is long-term care insurance far cheaper, it has the huge advantage of immediately (upon issuance of the policy) providing you with $100,000 in long-term care protection. You don’t have to wait for 20 years for the lump sum or annual saving alternative to grow to $100,000!

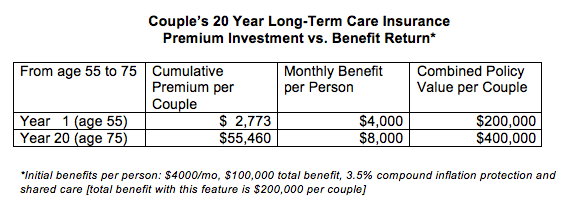

The above chart gives you an example of what a 55 year old couple would invest annually for 20 years and what they would have in return for their premium investment. The first year long-term care insurance premium cost would be $2773 and they would immediately have a combined total benefit of $200,000 to use for a qualifying long-term care event at the rate of $4,000 a month per person. Over 20 years the benefit would grow to $400,000, at a cumulative premium cost of $55,460. This premium investment for a $400,000 benefit would be the equivalent of getting an 11% compounded return on investment, which is not so easy to do today, or anytime!

In summary, long-term care insurance has several benefits over other ways to pay for an long-term care event. To begin with, you’ll recall from our post Long-Term Care Costs: Significant Enough to Worry About?, that there’s a major tax burden on top of the cost of long-term care when you pay for it by taking money out of a 401[k], IRA or tax sheltered annuity where you’ve not yet paid taxes on the money. If you intend to protect yourself against the cost of a future long-term care event, the least expensive and best way to do it is to buy long-term care insurance. And, finally, this last chart shows you that your investment in a long-term care insurance policy can give you an unusually good return on your premium investment, 11% compounded/year, assuming you use the full benefit that’s available to you.