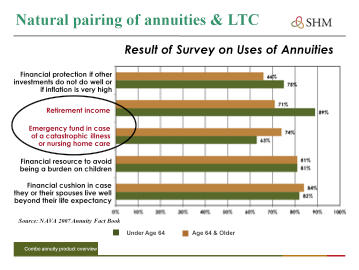

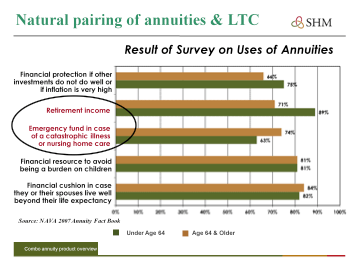

Surveys regularly show that when people describe what they have saved, over a lifetime, above what they need to live on, they often use words like a “nest egg,” “something to fall back on,” or a “rainy day fund.” When asked to explain for what they would use these funds, among the highest ranking answers is “emergency fund in case of a catastrophic illness or nursing home care”.

Here’s an example of how someone could fund a future long-term care event. Let’s say that you are 55 years old and wanted to begin protecting yourself now for a $100,000 long-term care event in 20 years when you’re 75. There are 3 simple ways to accomplish this:

- Invest a lump sum of $53,000 or

- Invest $3,500 annually for 20 years. With a 3% growth over 20 years this would grow to $100,000

- Buy a $100,000 long-term care insurance policy for $1200 per year per couple [assumes they are in in average health for 55 year olds]. Over 20 years, the premium cost will be $24,000.

As the chart shows below, not only is long-term care insurance far cheaper, it has the huge advantage of immediately (upon issuance of the policy) providing you with $100,000 in long-term care protection. You don’t have to wait for 20 years for the lump sum or annual saving alternative to grow to $100,000!

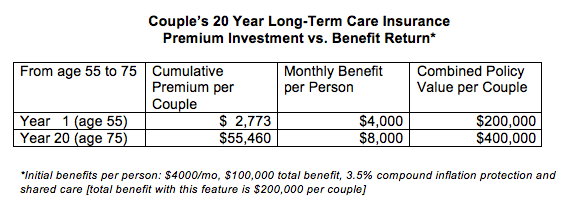

The above chart gives you an example of what a 55 year old couple would invest annually for 20 years and what they would have in return for their premium investment. The first year long-term care insurance premium cost would be $2773 and they would immediately have a combined total benefit of $200,000 to use for a qualifying long-term care event at the rate of $4,000 a month per person. Over 20 years the benefit would grow to $400,000, at a cumulative premium cost of $55,460. This premium investment for a $400,000 benefit would be the equivalent of getting an 11% compounded return on investment, which is not so easy to do today, or anytime!

In summary, long-term care insurance has several benefits over other ways to pay for an long-term care event. To begin with, you’ll recall from our post Long-Term Care Costs: Significant Enough to Worry About?, that there’s a major tax burden on top of the cost of long-term care when you pay for it by taking money out of a 401[k], IRA or tax sheltered annuity where you’ve not yet paid taxes on the money. If you intend to protect yourself against the cost of a future long-term care event, the least expensive and best way to do it is to buy long-term care insurance. And, finally, this last chart shows you that your investment in a long-term care insurance policy can give you an unusually good return on your premium investment, 11% compounded/year, assuming you use the full benefit that’s available to you.

Be sure to subscribe to our Seek On blog to recieve every post in this series straight to your inbox!

Check out the other posts in our long-term care insurance blog series:

Long-Term Care Insurance: Getting the Facts

What is Long-Term Care Insurance?

Doesn’t My Health Insurance & Medicare Pay for Long-Term Care?

Long-Term Care Insurance: “Bank Account” For Long-Term Care

Long-Term Care Costs: Significant Enough to Worry About?

Howard Rubin, LifeSprk Long-Term Care Insurance Program Administrator

Prior to managing the Lifesprk Long-Term Care Insurance (LTCi) Program Howard was the founder/CEO of BASi, a leading provider of LTCi to teachers & other association members and employees in their company sponsored programs. His clients have included state education associations in MN, WI, IN and FL and organizations like Wells Fargo, Cargill and the U. of St. Thomas.

Just as LifeSprk is on the cutting edge of life care management servicee, our LifeSprk LTCi Program will be breaking new ground for those looking for an introduction to LTCi and those that already have policies, looking for an objective policy assessment. Please contact us for more information about our LTCi services and where and when we’ll offering seminars.